The Greeks Request

The purpose of the greeks request is to provide greek information from a specific option instrument, based on the greek settings used in the request.

The greeks format

The greeks request must be formed by the option instrument symbol and the greek definition. These are separated by the exclamation mark ‘!’, while the greek definition must be enclosed in single quotation marks ‘’.

OPTION_SYMBOL!'GREEK_DEFINITION'

The OPTION_SYMBOL parameter is the option instrument symbol used in QST.

Note

For option instruments, you can either use the actual symbol of the option, e.g. EWZ20C3400 (E-mini S&P End of Month options), or using the underlying symbol instead, e.g. ESZ20{EW}C3400 .

Greek_Type@Greek_Model@Implied_Volatility_Representation_Precision@Use_Last_Price_Format_for_Value@Bid_Ask_Futures@Bid_Ask_Options@Enable_Custom_Volatility_for_Greeks@ROI@Custom_Volatility

Possible values for Greek_Type:

DL – Delta

GM – Gamma

RH – RHO

TH – Theta

VG – Vega

Possible values for Greek_Model:

Black-Scholes

Black76

Binominal

Trinominal

Whaley

The Implied_Volatility_Representation_Precision can be an integer value, e.g. 4.

The Use_Last_Price_Format_for_Value is a boolean value: “true” or “false”;

The Bid_Ask_Futures is a boolean value: “true” or “false”;

The Bid_Ask_Options is a boolean value: “true” or “false”;

The Enable_Custom_Volatility_for_Greeks is a boolean value: “true” or “false”;

The ROI (Rate of Interest) is a double value or “NaN” if not a number;

The Custom_Volatility is a double value or “NaN” if not a number;

Note

Only one option instrument and greek definition can be used per greeks request.

Examples of greeks request

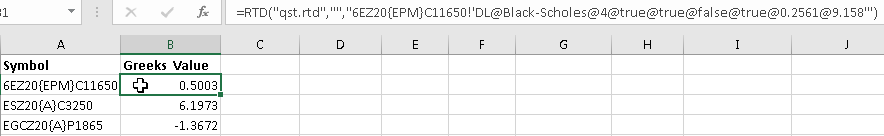

Requesting the Delta greek value for 6EZ20{EPM}C11650 (CME EUR/USD Premium) European option computed with Black-Scholes model:

=RTD("qst.rtd","","6EZ20{EPM}C11650!'DL@Black-Scholes@4@true@true@false@true@0.2561@9.158'")

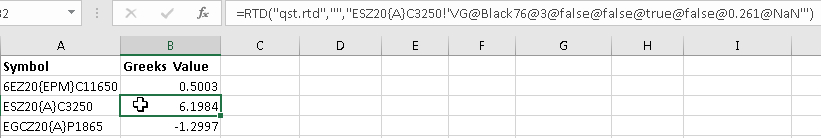

Requesting the Vega greek value for ESZ20{A}C3250 (CME E-mini S&P) American option computed with Black76 model:

=RTD("qst.rtd","","ESZ20{A}C3250!'VG@Black76@3@false@false@true@false@0.261@NaN'")

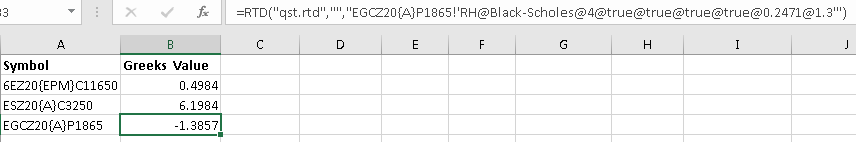

Requesting the RHO greek value for EGCZ20{A}P1865 (COMEX Gold) American option computed with Black76 model:

=RTD("qst.rtd","","EGCZ20{A}P1865!'RH@Black-Scholes@4@true@true@true@true@0.2471@1.3'")